The Red Sea Escalation Implications on Global Seaborne Trade

Examining the current state of seaborne trading in the Red Sea today and assess its influence on freight rates using Signal Ocean data

The Red Sea Escalation Implications on Global Seaborne Trade

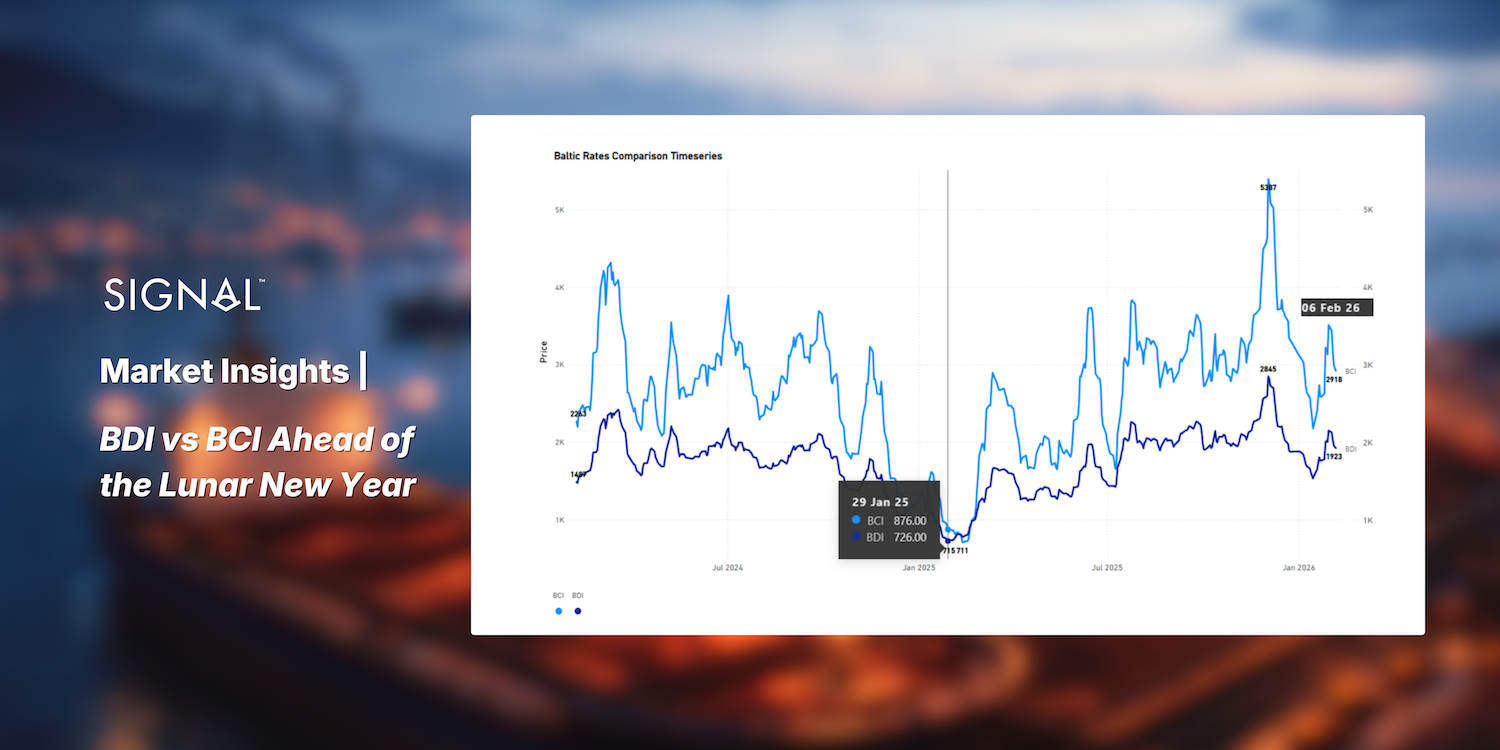

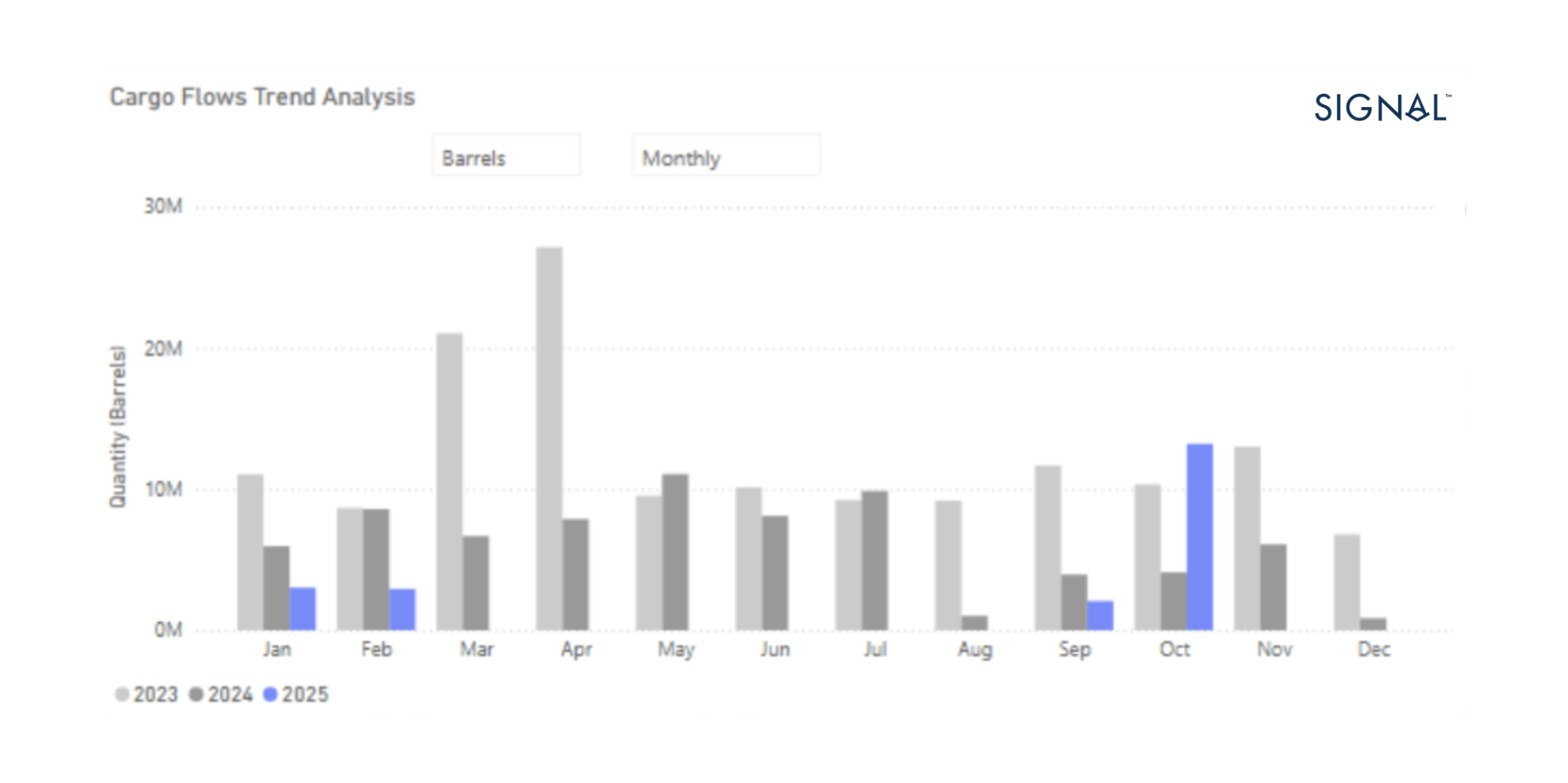

In recent days, discussions have intensified about the potential impact on the seaborne trade and ton-miles due to the evolving dynamics of market spot rates in various shipping segments. The recent attacks by the Houthi rebels in the Red Sea have already started to significantly affect trading activities, especially in the container segment. With the start of the new year, the crisis now appears to be impacting Red Sea vessel counts in the crude tanker segment, while spot rates in the Atlantic routes have spiked and piqued the interest of the market, signalling an escalation of the crisis with daily occurrences of new attacks.

In the dry bulk segment, the market has not experienced a significant impact yet. However, as time progresses, the threat of Houthi attacks on both dry and wet seaborne trade appears to be escalating. Figure 1 below, examines which segments were the most exposed to Suez canal crossings in 2023. Suezmax and Aframax and Supramax and Panamax represent more than half of the total crossings in tankers and dry bulk respectively.

Using Signal Ocean data, it becomes quickly clear that if we want to look for the most affected trades we need to start with the crude oil Suezmax and Aframax trades and the agricultural commodities transported with Panamax and Supramax dry bulk vessels.

But what happens if the effects already clearly felt in container traffic begin having a deeper impact on wet and dry bulk commodities too? The obvious ramification, namely the detour of ships via the Cape of Good Hope can certainly increase further, even beyond 50%, as we are increasingly encountering and anticipating announcements of suspension of shipments via the Red Sea. Several major shipping companies have already announced the suspension of shipments, while more are saying they are closely monitoring the situation and are about to make a decision. The shipping associations BIMCO, ICS, CLIA, IMCA, INTERCARGO, INTERTANKO and OCIMF have already issued joint guidelines emphasising the importance of a relevant hazard and risk assessment. This includes considering additional advice from the ship's flag state before transiting the area in question.

So how much would the various vessel classes be affected if suspension of crossings escalate? We begin looking for an answer by inspecting the exposure of each class to the relevant routes. In Figure 2, we can see the percentage of voyages with a Suez canal crossing for each vessel class and the total number of global voyages. Almost one in five of the approximately 6,000 global voyages for Suezmax crossed the Suez canal in 2023, for example.

So, not only do Suezmax and Aframax tankers, together with Supramax and Panamax Dry, dominate the canal’s time, but it appears that crossing it happens while serving a very substantial part of the total global ton-miles for the trades these vessel segments serve.

Zooming out from the shipping intricacies, we also need to consider the impact from the perspective of the affected commodities. In Figure 3, we see that 20% of the worldwide trade for fertilizers goes through Suez. Gains and clean petroleum products are also highly exposed with a 13% and 10% share respectively.

Although there has been speculation that Houthi attacks have been more focused on containers, any such situation is so volatile that nobody can actually predict how it will unfold. So there is little ground to sustain that re-routing could be based on segment and/or cargo considerations. Rather, as it is always the case, risk vs cost and benefit is likely to determine where we go from here.

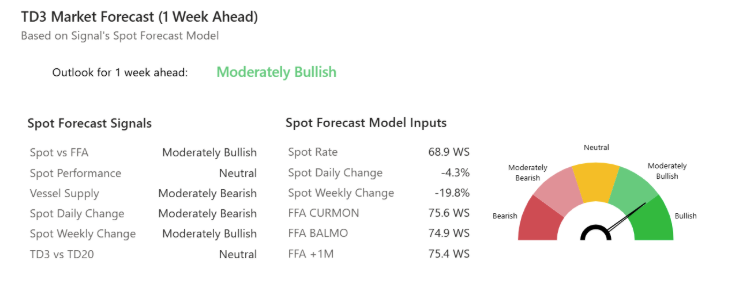

The impact on the Freight Market

The spot market for crude oil tankers is already seeing an upward trend in the Atlantic routes, particularly with Suezmax rates in the West Africa to UK/Continent and Aframax rates in the Mediterranean trades. These markets had last surged in November ‘23 and mean-reverted over the holiday season. The decline in vessel numbers foreseen in the Red Sea for the tanker segment has already reached a record low since the beginning of last year, resulting in an increase in WS rates for the Suezmax Wafr-UKC of more than 50% to a level of around 140 WS and Aframax Cross Mediterranean rates of over 200 WS. (Figure 4) In the VLCC segment, a spike has also been observed for the West Africa to China run, with rates at around 70 WS, an increase of almost 40% year-on-year. With Suezmax and Aframax more exposed to the canal, the impact appears to be more direct.

The looming risk appears to escalate, and the duration of the disruption will play a crucial role in determining the extent of its impact. Depending on the duration, it could usher in a substantial wave of consequences, notably affecting the increase in tonne miles for major oil trading routes.

Utilising Signal Ocean data, we conducted a sensitivity analysis (Figure 5) to delve into the magnitude of the impact on trading, seeking to discern patterns and trends in response to the unfolding events.

Sensitivity analysis

Having established the more direct impact on Suezmax tankers and the relevant commodity flows, we take an opportunity to reflect on what might come to pass by way of sensitivity analysis. We examined the Suezmax tanker vessel class in light of recent developments at the Suez Canal crossing. The observed decline in the number of dirty tankers in the Red Sea is notably influenced by the current situation, exerting upward pressure on market prices. The figure below illustrates how ton-miles could potentially increase under various scenario percentages, should there be a decision to reroute ships via the Cape of Good Hope. The data indicate a significant impact, with rerouting scenarios of over 40% share leading to a potential global ton-mile increase of more than 10%.

Sensitivity analysis scenarios potential % shares of Deviation: 10%, 20%, 40% , 50% and 100%

Looking at the Suezmax vessels engaged in the trade route between the Black Sea and India, the potential impact of maintaining the current route versus rerouting through the Cape of Good Hope is significant. The distance travelled would be three times as long, which means that the freight would need to be almost double in order to achieve the same earnings (TCE). In the case of Black sea to India for example, the freight increase could be in the order of $4 million. This corresponds to an overall increase in transportation costs of the order of $7 per barrel.

In the event of such a rerouting scenario, the critical question is whether India would develop alternative sources of crude oil in the Arabian Gulf or West Africa. It is also uncertain whether Russia would adjust its crude oil prices downwards to remain competitive, taking into account the additional transportation costs. This complex interplay of factors underscores the importance of potential changes to shipping routes and their broader economic impact.

How players have responded to the Red Sea threat

The escalation of Houthi attacks in the container segment since December and the announcement by a number of players to halt transit traffic has led to others following suit and the list of names in other shipping segments is growing longer. In the energy sector, Torm and Shell appear to be amongst the most vocal and decisive movers, while BP joined the list back in December. Despite the challenges, Chevron has maintained its crude oil shipments in the region, working closely with the US Navy's Fifth Fleet. The unrest in the Red Sea poses a significant threat to the uninterrupted flow of oil. If the escalating tensions lead to a significant disruption of supply in the Middle East, prices could fluctuate rapidly, according to Michael Wirth, Chevron's CEO. January days exacerbate the negative impact on the crude oil supply chain as oil prices spiral downward.

Looking ahead

Surpassing the 100-day mark, the conflict in the Middle East appears to have transitioned into a new phase. Despite China being Israel's second-largest trading partner, Beijing has maintained silence on the ongoing war between Israel and Hamas in the Gaza Strip. However, in a recent development, China has called for an end to attacks on civilian vessels in the Red Sea. The Indian economy is now under a serious risk for a significant increase in the cost of crude oil imports. There is a market speculation that the ongoing tensions in the Red Sea could lead to a $10-20 increase in oil prices for oil-importing countries like India, which could have negative effects on its economy.

Nevertheless, it's remarkable that oil prices have been struggling to break through the 80 dollar per barrel barrier for several weeks despite the heightened tensions in the Red Sea. Against speculative scenarios that oil prices could rise to over $100 per barrel in the first half of the year due to a direct threat to crude supply, the current picture of oil prices is developing below the exaggerated estimates.

There is no doubt that the Houthi attacks have significantly disrupted container trade, leading to uncertainty about the duration of these disruptions. Across the world, shipping companies are adapting to changing market conditions. While the impact on the container trade is obvious, the extent of the impact on other categories of goods trade remains uncertain. So far, the attacks have not yet had a major impact on dry bulk and tanker shipping.

In the oil sector, the observed decline in transits across the Red Sea is primarily the result of precautionary measures taken by the energy industry to prevent a recurrence of the problems in the container segment. In the dry bulk sector, the recent attack on a Supramax bulk carrier is a cause for concern. This incident raises fears that there could be further attacks in the future, leading to increased deviations and spot rates in the smaller bulk trade. The full extent of the impact on the various commodity segments remains to be seen as the situation continues to evolve.

For more in-depth information and access to the Signal Ocean Platform, please don't hesitate to contact us. Stay informed, stay connected.

Ready to get started and outrun your competition?

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.avif)

.avif)