Using Signal Ocean data, we analyse the trends and changes across the major vessel sizes in the dry and tanker freight market for 2021. This report provides data on demand, supply and how the latest developments determined the performance of vessels’ earnings. The year to date evolution in supply and demand paves the way for the stronger or weaker performance of freight rates in parallel with the global changes in the macroeconomic environment and the challenges arising from the growth of the world’s second largest economy: China. This time last year, we analyzed the effects of the coronavirus pandemic on commercial shipping with a focus on dirty tankers - VLCC, clean tankers - LR2 and dry - Capesizes.

With the end of 2021, global eyes are on Omicron and whether or not it will significantly reduce economic growth.

The world economy is said to be experiencing just 0.7% growth, in the final three months of the year, according to Bloomberg estimates. This is half the growth of the previous quarter and below the pre-crisis rate of around 1%.

With our annual review this year, we monitor the sentiment of demand and supply in the dry and tanker for crude and product segments. We initially focus on demand to capture the dynamics before we examine the supply trend lines with impact on freight rates and how the movements of the fourth quarter of this year could lead to euphoria in 2022.

SECTION 1: Demand

Dry - The Big Picture and Smaller Vessels

The big challenge for the evolution of seaborne demand for dry vessels is always the performance of the Chinese economy. We estimated the demand in ton days growth for this year per main dry bulk ship size and we envisaged a clear higher trend of growth for the Capesize segment, (chart 1), that boosted the sentiment of Capesize freight rates during October to the highest level since 2009. The question now is what about 2022? There are some early indications signalling a lower expansion in the growth of China, the world’s second largest economy, that will influence the evolution of demand for seaborne transportation for Capesize vessels.

Market consensus is that the growth of the world’s second largest economy will vary from 5% to 5.5% in 2022 as there were no records of sharp rebound within this year. The Chinese Academy of Social Sciences and the People’s Bank of China estimate China’s potential growth rate to be about 5.5% for 2022. Chinese growth slowed in the second half of this year, and there are predictions that the figure will be below 4% for the final quarter. However, official estimates for the full year growth will be released in mid-January.

Tankers - Demand Crude and Product

2021 ends with significant recovery in demand for Very Large Crude Carriers (VLCCs), whereas the last quarter has seen downward movements for Suezmax and Aframax vessels (chart 2). In the product segment, demand gives signs of slowing down with December ending at lower levels than the levels of the beginning of the fourth quarter. It is worth mentioning that MR1 vessel size keeps firm growth as we are heading towards the coming days of the new year (chart 3). The challenge on the growth for seaborne demand on crude and product for the upcoming demand growth in ton days is the current daily rising of covid cases.

There are fears of the impact of the Omicron variant on oil demand with EIA, OPEC and the US Energy Information Administration concluding at different positions of estimates for the next year. The IEA in December’s Oil Market Report (OMR) estimated global oil demand to rise by 5.4 mb/d in 2021 and by 3.3 mb/d in 2022, when it returns to pre-pandemic levels at 99.5 mb/d.

Demand - TonCharts Methodology

- The TonDays time-series graph presents ton days of the seagoing and stopped vessels (Laden) for the user-selected vessel class range that have loaded (Area From) and discharged (Area To) the selected areas.

- We define TonDays = Deadweight * VoyageDays and so TonDaysPerDay = TonDays / VoyageDays, where VoyageDays = LastSailingDate - FirstArrivalDate

- To compute the TonDays time-series, we aggregate for each day the TonDaysPerDay for all the seagoing and idle vessels for the given historical time window.

SECTION 2: Freight Rates

Dry- Capesize, Panamax, Supramax, Handysize

The evolution of dry market rates for the current year, chart 4, is undoubtedly one of the most profitable that dry bulk shipowners have seen lately, with rates following the ending of summer season surging to ten year highs. It was a year for Capesize and Panamax vessels, but it ended with a year of stronger performance for smaller vessels. The Handysize segment has shown signs of firm rebound over the last weeks of December, when Capesize and Panamax vessels are facing constant headwinds in the upward movement of rates. The fears of a weaker Chinese economic growth and the ongoing cuts of steel productions for a greener future pose a serious challenge on the euphoria of earnings for the large vessel sizes. The energy crisis in China that came suddenly in November with a significant volume of Indonesian coal imports boosted the sentiment of Panamax rates, however, now the issue seems resolved and vessel earnings are showing more volatility towards lower levels.

Tankers - Crude and Product

Although dry bulk rates were hovering throughout the year above their 2016-2020 average, crude tanker rates performed at very weak levels during the second and third quarters of this year, with a trend of recovery in December (chart 5). Overall, 2021 is on track to be one of the worst years for spot crude trades since 2009. The sentiment in the VLCC size for AG to Far East route remained at negative pressure throughout the year and recorded the weakest levels of WS. The fourth quarter will end with a clear upward trend for Aframax Med rates, whereas Suezmax vessels are still facing serious headwinds with some signs for an improved performance that seemed short term.

In the product segment, November shifted the sentiment to stronger rates, chart 6, with significant upward movements in Panamax Carib to USG rates and in MR1 clean Algeria to Med. In the MR2, Continent to US rates are gradually recovering but the upturn is not so aggressive compared to the spike of MR1 Algeria Med rates one week before the ending of this year. The last days of December decelerated the euphoria seen in MR1, however, levels are standing at the highest point for this year.

SECTION 3: Supply Trend

In this section, we monitor the evolution of ballasters for dry bulker vessels at key main trading routes with impact on benchmark freight route rate assessments, and in the tanker segment, the supply trend for the crude and product tanker vessel sizes at selective key trading routes in line with the performance of WS rates. We illustrate the issue of port congestion for dry bulk vessels in China and the number of last days of the year. For 2021, the volume of vessel congestion at Chinese ports had a significant impact on the spikes of dry bulk freight rates the market experienced during the second and third quarters.

Dry - Ballasters’ View

The current picture of the number of vessels sailing in ballast status (chart 7) is now on a decreasing trend, standing below the one year average apart from the Handysize vessels. The last quarter of the year signalled a gradual easing of the number of vessels sailing without cargo as this coincided with the resolving issue of port congestion (chart 8) around Chinese ports. Week 40 at the beginning of October was characterised by the lowest number of Capesize and Panamax vessels sailing in ballast status SE Africa towards Brazil throughout the year, whereas in the Supramax segment, the lowest number was recently seen at week 51. In the Handysize segment, the lowest number of ballasters in NOPAC area came at almost similar moment with the large vessel sizes, at week 39, while during the last days of December, the number has started again to fall towards the one year average following the spike at week 50.

This year’s evolution comes to confirm that despite the headwinds in the macroeconomic environment, the seaborne demand for raw materials keeps more vessels employed and the seasonal weakness of rates is likely to be smoothed at the opening of the new year with challenges of downward pressure at the first days of February with the Chinese New Year.

Port Congestion - China, Dry Vessels

It is immediately apparent when looking at dry bulk vessel congestion, chart 9, that the smaller dry bulk vessel sizes, Handysize-Handymax, are still experiencing port logistics supply chain issues. These are the only vessel sizes appearing with still high levels throughout the year that can also explain the upward sentiment of freight rates in the Handysize market in NOPAC area during December. It is worth mentioning that at the large vessel sizes, despite the constant declining levels since week 46 for Capesize and very large ore carriers, the last two weeks of December emerged with an increasing momentum with the number of Capesize ship congestion almost surpassing the annual average. We closely monitor this latest trend and its impact on freight rates for the first days of January’s new year.

Tankers - Supply Trend

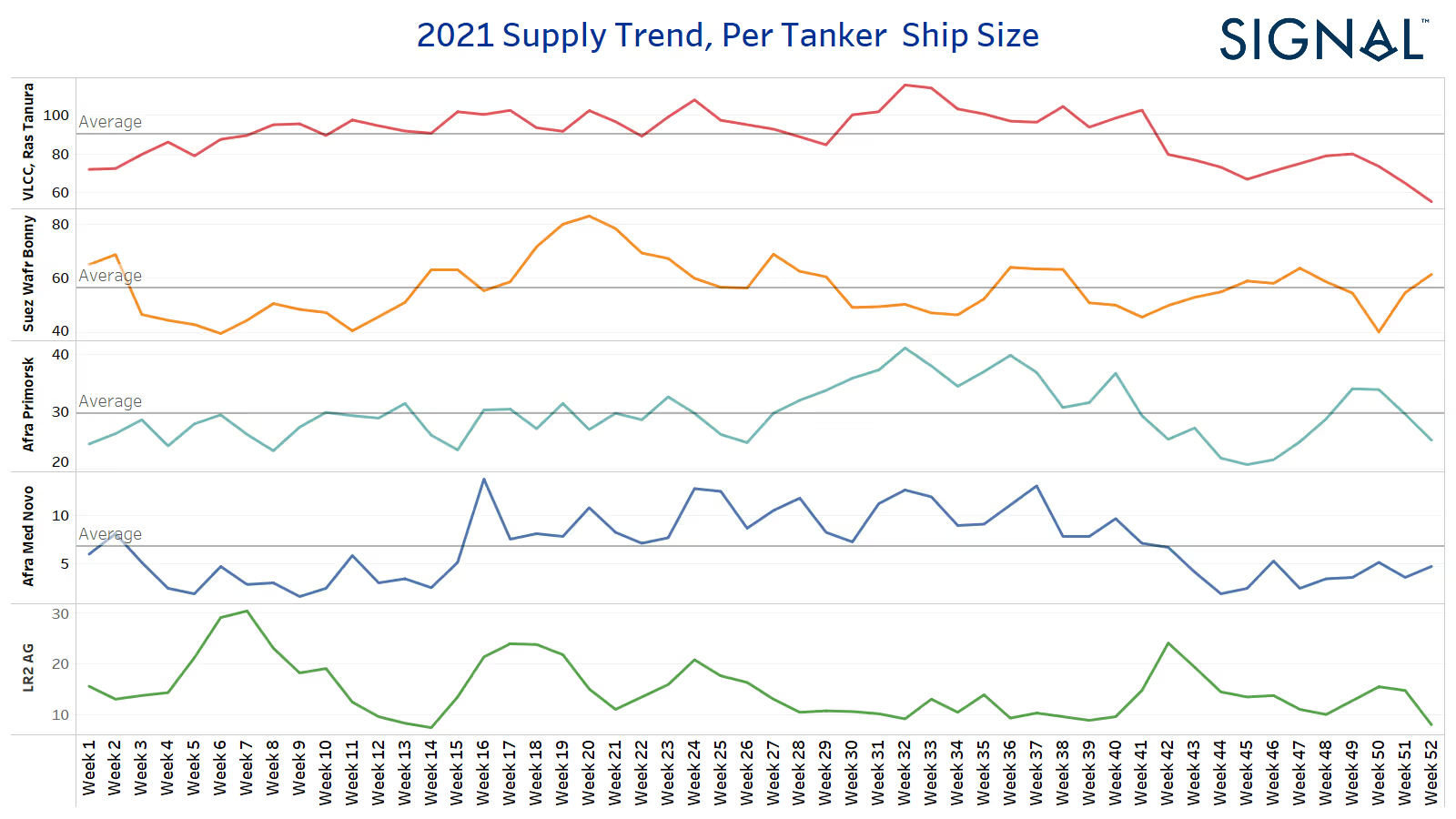

The supply trend for crude and product tankers at the key trading routes, chart 9, confirm the optimistic sentiment of the upward trend of rates at the last days of December towards the beginning of the new year. In the VLCC segment, load port Ras Tanura, we see that the market experiences a declining number of sailing ships from week 45, at the beginning of November, and fetched levels far below the average of one year ~ nearing to 60 vessels compared to more than 100 vessels at the beginning of August. In the Aframax segment, the trend is also heading downwards in the Mediterranean and Baltic, whereas in the Suezmax, we see again an increasing trend above the average of this year that will push towards a weaker sentiment of freight rates. In the LR2 AG route, the market is experiencing again one of the lowest number of vessels sailing that comes in line with the surprising upward cycle of WS rates.

Bunker prices and Savings for Shipowners

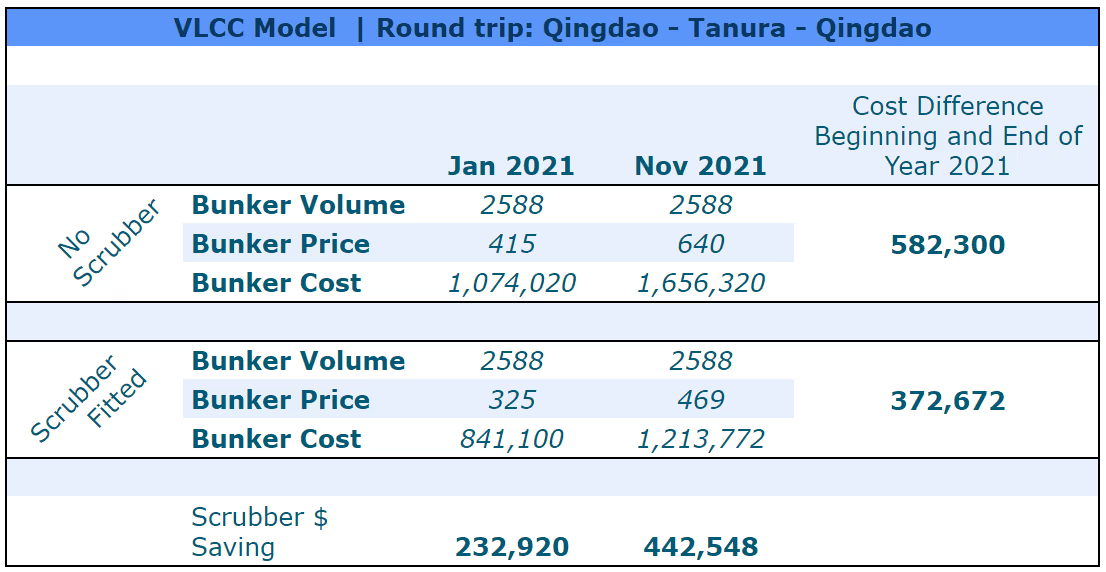

Compared to the turmoil of 2020, this year has been relatively straightforward for bunker prices - they have only really moved one way - up. January 2021 saw prices for VLSFO in Singapore start at around US$415 per MT and reach US$640 by the end of November, representing gains of more than 50% before falling to US$600 per MT on the back of Omicron-fuelled fears of a global economic slowdown. Of more interest however has been the spread between high and low sulphur grades of fuel oil as the world has attempted to return to normal after the turbulence of 2020. The year started with low sulphur grades attracting a premium of less than US$100 per MT, before increasing to US$120 by the summer and then widening to almost US$200 by the beginning of December.

In real terms, this means that the voyage costs of shipping companies have increased by 50% in 2021 and scrubber-fitted vessels have enjoyed more cost benefits as the year has progressed.

What does this year say for 2022?

Overall, identifying the winning vessel class of 2021 is not an easy task. 2021 will be remembered for the exceptional bounce back that dry Capesize bulkers experienced. The changed momentum for the large crude carrier vessels and significant spike moments in LR2 product tankers is not to be forgotten, too. The demand trend, in ton days, supports a healthy momentum of freight rates for Capesize bulkers, whereas the crude tankers are going to face the impact of fears from Omicron variant on demand. However, the supply trend of December supports the gradual recovery of the tanker freight rates. The issue of Chinese port congestion seems to remain in the same focus for the first days of the new year and will determine the evolution of dry freight rates. Lastly, the energy crisis with Chinese efforts to decarbonise their power sector has triggered an intense debate over the last days on securing smooth energy transition and the changes on fuel demand landscape and prices.

This 2021 annual market report for dry bulk and tankers segment was produced using insights, data and reports from the Signal Ocean platform.

-Republishing is allowed with active link to source

Ready to get started and outrun your competition?